5 percent deposit mortgage

- Raghvir

- Aug 10, 2019

- 2 min read

Updated: Aug 23, 2019

Many people only have low deposit of 5 percent, and always have question in their mind whether they can get a mortgage or not, due to the small deposit when buying their first property without any mortgage scheme.

So, the answer is YES, as nowadays many banks offer 5 percent deposit mortgages, where if you meet their lender affordability criteria then you are able to get mortgage on your first property purchase.

So, the lenders are now offering 95% loan-to-value rates without support from the Help to Buy scheme.

Even last week one of the Building Society relaunched its range of 95% loan-to-value mortgages targeting first-time and next-time buyers. The lender is planning to support one in five first-time buyers by boosting its mortgage lending by £1 billion over the next 12 months.

For help to secure a low deposit mortgage call Bright Sun on 02080641618.

There are still other schemes available if you are buying your first property, here are the scheme’s: -

What is Help to Buy - Equity Loan?

The Help to Buy - Equity Loan is a Government-backed scheme exclusive to new build homes. It was set up by the Government in 2013 and has already helped thousands to make their move onto or up the property ladder.

The idea behind scheme is that, with the Government providing a portion of the required equity in the form of the equity loan, homebuyers need to borrow less from traditional lenders, and require a smaller deposit.

With the Help to Buy - Equity Loan - a dream move into a brand-new Home could be closer than you think.

How does the Help to Buy – Equity Loan work?

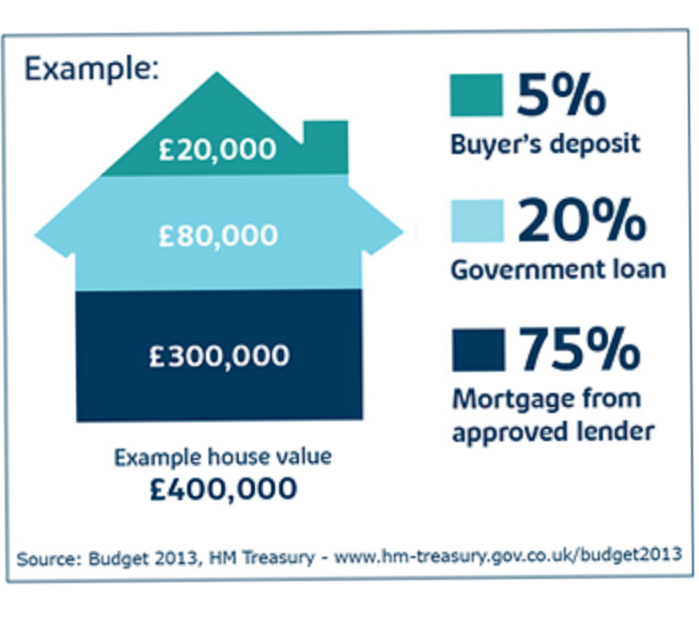

By using the scheme, you need just a 5% cash deposit, with the Government providing an equity loan of up to 20% of the value of the property you’re buying. You then need to secure up to a 75% mortgage which opens the door to more competitive lending rates and may make your repayments more affordable than you first thought.

What’s more, you won’t be charged interest or fees on the Government equity loan for the first five years of owning your home, and you can choose to repay the equity loan at any time without penalty, or on the sale of your home.

The scheme is available for first-time buyers and existing homeowners alike, on new homes up to a maximum purchase price of £600,000.

So, if you thought a high-quality brand-new home was out of reach – think again. Come and speak to one of our advisors, and let’s see if we can get you moving.

Comments